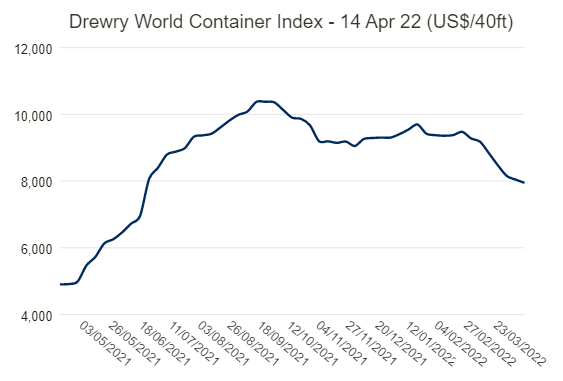

Drewry's latest Composite World Container Index fell 1.2% to 7,945.31 per 40ft container in the current period. However it is still 62% higher than the same period last year.

The average WCI composite index assessed by Drury so far this year is US$9,038 per 40ft container, which is US$5,805 above the five-year average of US$3,232 per 40ft container.

The Drury Index showed a seventh consecutive week of falling freight rates since 24 February 2022.

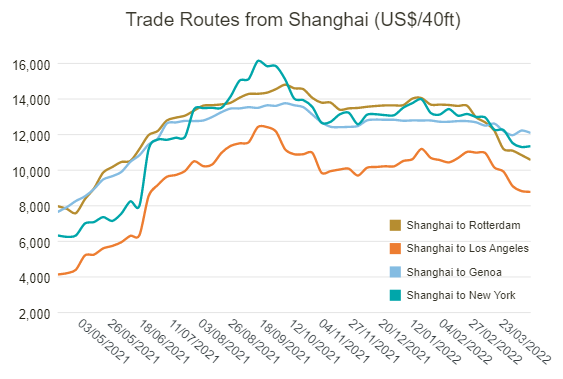

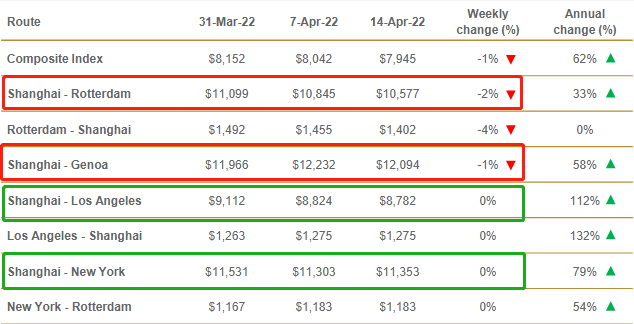

Shanghai-Genoa freight rates fell by 1% or US$138 to US$12,904/FEU.

Shanghai-Rotterdam freight rates fell by 2% or USD 268 to USD 10,577/FEU.

Shanghai-Los Angeles and Shanghai-New York freight rates remained almost unchanged compared to the previous period at US$8,782/FEU and US$11,353/FEU respectively.

Drewry expects spot rates to remain stable in the coming weeks.

Translated with www.DeepL.com/Translator (free version)

此外,本期最新波罗的海货柜运价指数(FBX),数据显示:

The Asia to US West latest index fell marginally by 0.3% to US$15,764/FEU, a recent decline for the fifth consecutive week since reaching a high of US$16,353 on 11 March.

The Asia to US East latest index remained largely unchanged from the previous period at US$17,150/FEU, also a recent decline since reaching a high of US$18,450 on 11 March.

The Asia to Northern Europe latest index was down 1% to US$11882/FEU, the 12th consecutive week of decline since reaching a high of US$14,999 on 28 January.

The latest Asia to Mediterranean index fell 1% to US$12,592/FEU, a decline for 13 consecutive weeks since reaching a high in January.

The Shanghai Export Containerised Freight Index (SCFI) released by the Shanghai Shipping Exchange on April 15 ended marginally lower at 4228.65 points, down 35.01 points compared to the previous period's 4263.66 points.

Translated with www.DeepL.com/Translator (free version)

Recently, freight rates on South East Asia routes have skyrocketed recently.

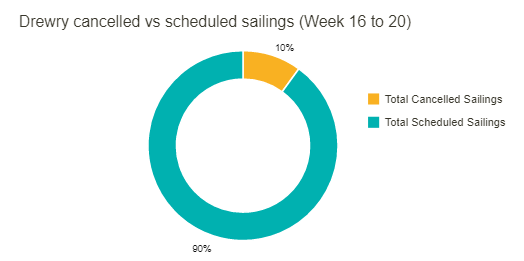

According to the latest data released by Drury, the three major global shipping alliances have cancelled a number of voyages in the next five weeks (weeks 16-20), with the most cancelled voyages being cancelled by THE Alliance with 25 voyages; 2M Alliance reaching 17 voyages; and the least cancelled by Ocean Alliance with 12 voyages; for a total of 54 voyages.

Drewry said the ongoing epidemic closure has put pressure on an already stretched supply chain and shipping lines such as Maersk and Duffy Shipping have started to port hop Shanghai on some routes.

In addition, port congestion at high throughput ports has increased again, particularly in the US, where imports have shifted from the US West Coast to the US East Coast. Many shippers are now focusing on Gulf routes and moving cargoes to the Port of Houston. With changing port productivity levels, planning for shippers in times of market uncertainty has become more challenging.

Of a total of 725 scheduled voyages on major transpacific, transatlantic, Asia-North Europe and Asia-Mediterranean routes, 72 voyages were cancelled between week 16 and week 20 of next year, a cancellation rate of 10 per cent. According to Drewry's current data, 58% of blank sailings during this period will occur on the trans-Pacific eastbound trade routes, mainly to the US West Coast.

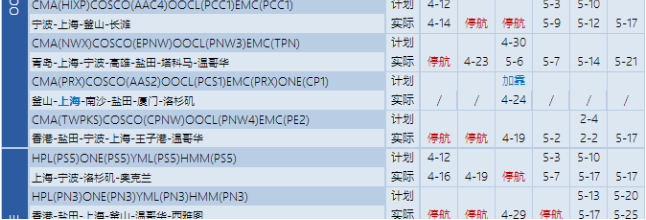

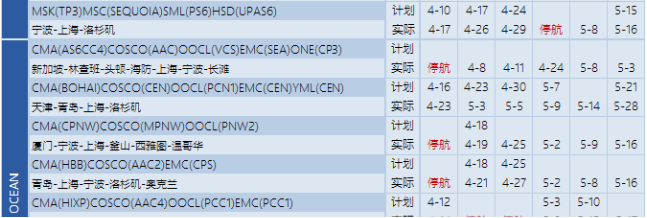

The following is a summary of easy sailing statistics for mainland China to North America, Europe and the Mediterranean for the 16th-21st week (from 2022/4/10 - until 2022/5/21) with port hopping.

版权所有©2019CNS INTERTRANS(SHENZHEN) CO. Ltd| 版权所有 粤ICP备12005868号

Hello, please leave your name and email here before chat online so that we won't miss your message and contact you smoothly.